NEWS

2025 in the retail industry, do not believe in myths

- Categories:NEWS

- Author:UM

- Origin:Internet

- Time of issue:2025-02-17 10:35

- Views:

(Summary description)

2025 in the retail industry, do not believe in myths

(Summary description)

- Categories:NEWS

- Author:UM

- Origin:Internet

- Time of issue:2025-02-17 10:35

- Views:

The attitude of the Chinese business community towards the ancient business of retail is splitting into two camps.

One type is optimists, such as Ye Guofu, the founder of Miniso.

In April 2021, he had lunch at Pangdong and found that the buns here were delicious, "even better than those in a five-star hotel". At that time, no one could have predicted that the person who opened Miniso to the world would spend nearly 6.3 billion yuan to acquire Yonghui three years later. Although the outside world had repeatedly seen this acquisition as a gamble, Ye Guofu himself firmly believed that "if you don't understand, you're right".

The other type is pessimistic.

Former CEO of Hema, Hou Yi, said in a recent interview, "I think what Chinese retail entrepreneurs lack most today is their cognitive level. Many people don't know how to play

The trigger for the disagreement between the two sides was the celebrity Pang Donglai in the Chinese retail industry.

In the past year, the "adjustment and reform trend" sparked by Pangdonglai has become a prominent phenomenon in the Chinese retail industry. Ye Guofu himself claims to be a fan of Pangdonglai, and the key reason for deciding to acquire Yonghui is to see the positive trend of Yonghui after Pangdonglai's adjustment and reform. But Hou Yi believes that "adjustment and reform" solve short-term problems, "treating the head when the head hurts, treating the foot when the foot hurts, and copying the management methods of some good enterprises".

From joining the Internet, learning from Sam and other foreign retail giants, to now regarding Fat Dong Lai as a new teacher, the adjustment of China's retail industry has been ongoing, but every year it is being questioned by a soul proposition:

Why don't consumers like to go to supermarkets anymore

The answer to the question is complex. The stratification of consumer demand, the path dependence of traditional retail, the strength of foreign retail giants, and the Internet e-commerce's thirst for traffic all increase the difficulty of transformation. To some extent, Pangdonglai is just a catalyst in the transformation cycle of China's retail industry.

If 2024 is seen as the year of cognitive awakening for Chinese retail, then 2025 will be the year after waking up, continuing to explore and return to the essence of retail.

In 2024, New Retail has figured it out,

Old retail has awakened

Alibaba will no longer mention the term 'e-commerce', because e-commerce is just a ferry boat that connects one end of the riverbank to another

In October 2016, Jack Ma, who appeared at the Yunqi Conference, predicted that the era of pure e-commerce would soon come to an end. In the future, Alibaba's "Five New" strategy (new retail, new finance, new manufacturing, new technology, and new energy) would profoundly influence the world, and new retail, as a part of Alibaba's core strategy, became the "new slang" of Alibaba at that time.

It was a prosperous era when the Internet was keen on coining words, and it was also an era when Internet giants were ambitious.

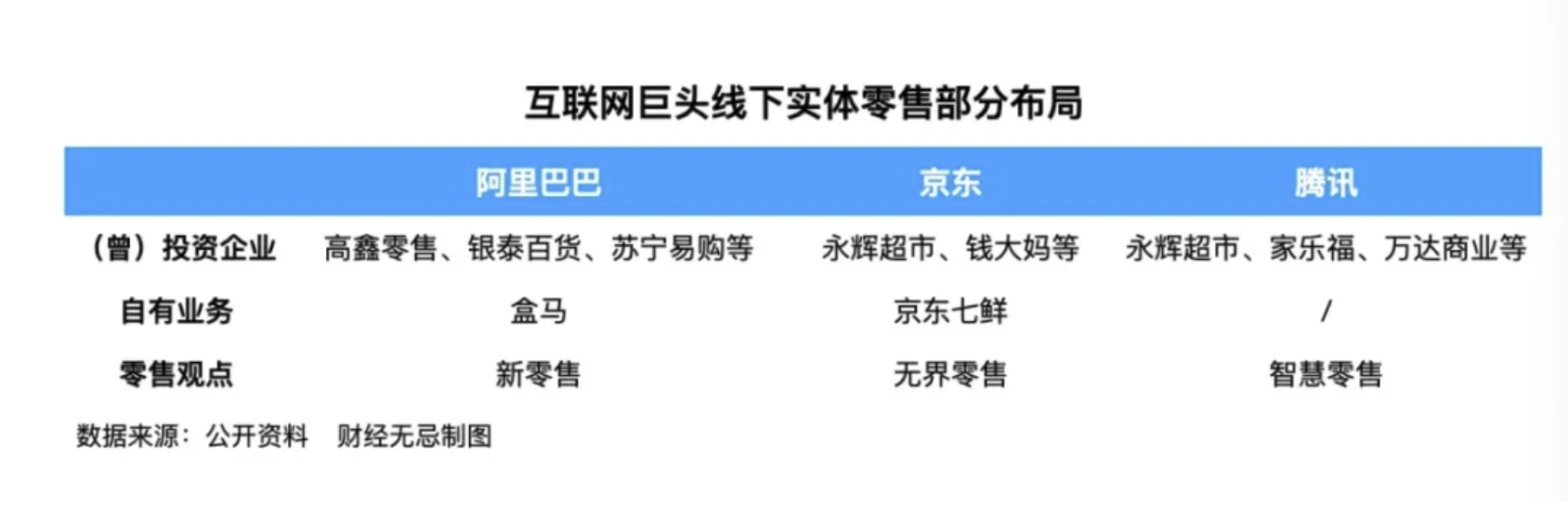

Subsequently, JD.com proposed "Boundless Retail", and Liu Qiangdong even suggested changing the name of next year's conference to "Boundless Retail Conference" at the 2018 China E-commerce Conference. Tencent also took the opportunity to propose the concept of "Smart Retail".

Correspondingly, Internet giants have made great efforts to transform traditional retail. On the one hand, they have invested heavily in physical retail. Alibaba has invested in Yintai, acquired Gaoxin Retail, and invested in Suning, Red Star Macalline and other leading enterprises; Tencent has successively made strategic investments in Yonghui Supermarket, Super Species, Carrefour and Wanda Business; JD.com has invested in Yonghui Supermarket and Qian Mama; On the other hand, they have also begun to try to become supermarkets, with Alibaba's Hema and JD's Seven Fresh being products of the new retail era.

There are two reasons why Internet giants are ambitious: first, the huge consumption power of Chinese consumers at that time, which was an era of consumption upgrading.

Ma Huateng once publicly responded to "many people ask why Tencent spends a lot of money to buy a large number of offline retail shares," mentioning that "with the upgrading of consumption, there are more and more middle-class people.

The central bank pointed out in a routine questionnaire at the end of 2018 that 28.6% of the respondents preferred to spend more, and the Internet giants who witnessed the e-commerce GMV war report data naturally wanted to bring this consumption upgrade offline.

The second is that giants who crave traffic see offline retail as a new entry point for traffic. The endless Internet technology can not only reach consumers more efficiently, but also further commercialize these offline traffic, precipitate data and transfuse blood for other businesses.

The Internet giant is more ambitious, and the offline hypermarket is more depressed.

The once advantageous categories of department stores, clothing, and home appliances in hypermarkets have been eroded by the low prices of e-commerce; The rise of diversified formats such as offline community group buying, member store discount stores, and professional category chain stores has intensified market competition.

The traditional supermarket, which has been attacked from behind and from behind, can only choose to embrace its biggest enemy, the rich and powerful Internet giant. From the perspective of traditional supermarkets, Internet giants can at least bring them "three gifts"——

One is to connect online and offline, leverage e-commerce online platforms, and save lost customer flow; The second is to solve the problem of not touching the "goods" in the past, and to explore diversified business formats by focusing on fresh food and other categories or creating their own brands; The third is digitization, which deepens the understanding of product and user operations in hypermarkets through the use of digital tools.

Huang Mingduan, founder of RT Mart, remembers that during his first meeting with then Alibaba CEO Zhang Yong, Zhang Yong asked Huang Mingduan two questions: First, do your stores want to digitize? Secondly, do you need to redirect traffic from online to offline?

I think about it all night, "Huang Mingduan said.

Regarding the "marriage alliance" between the two parties, Zhang Yong also has a comment: "RT Mart is different because of Alibaba, and Alibaba is different because of RT Mart.

But obviously everyone underestimated the cost of being 'different'. Since the Internet transformation, the revenue performance of traditional stores has not changed significantly.

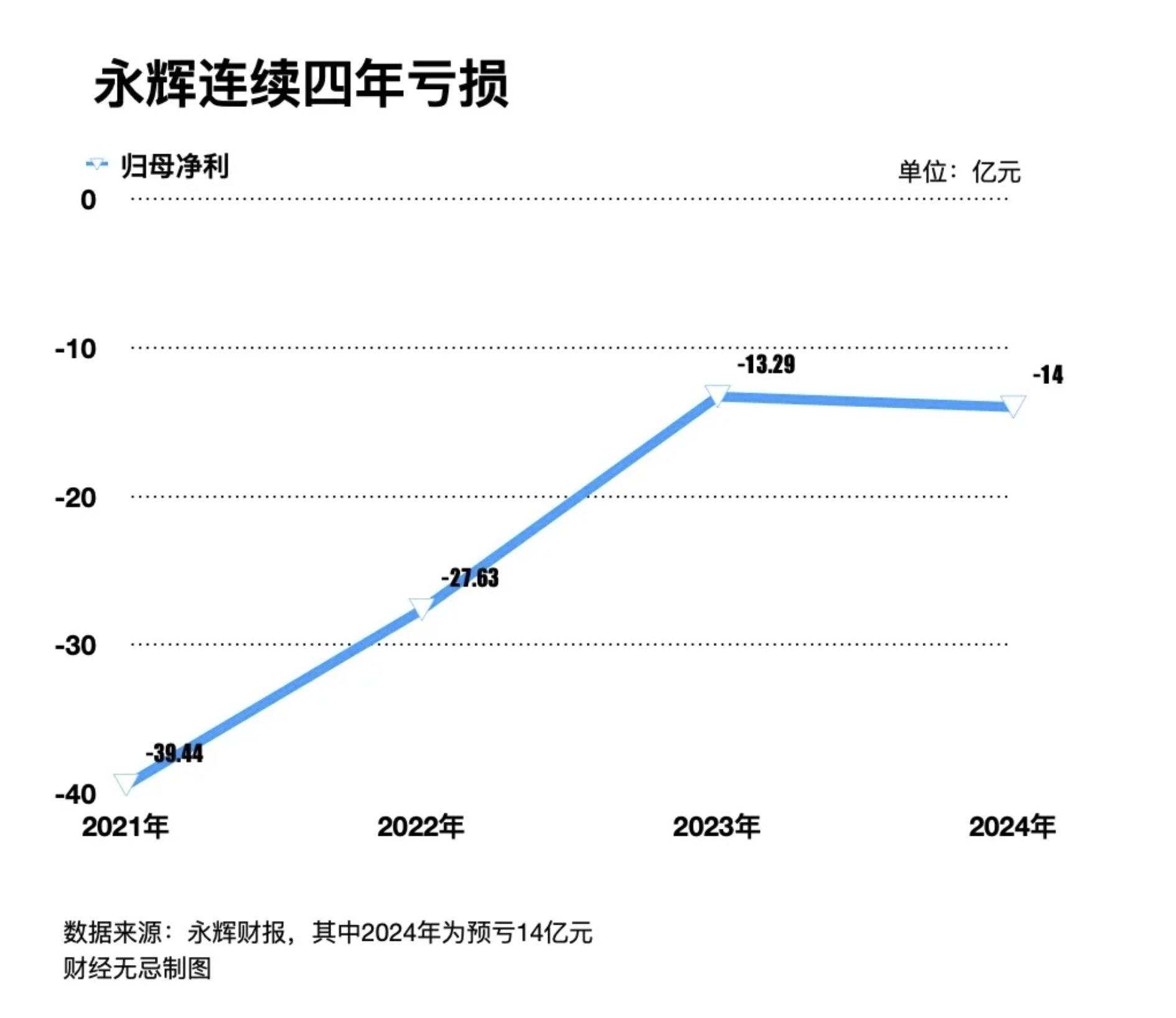

Yonghui suffered losses for four consecutive years from 2021 to 2024, with a cumulative net loss exceeding 9 billion yuan; During the fiscal years 2021 to 2024, the parent company of RT Mart, Gaoxin Retail, incurred a cumulative loss of nearly 3.2 billion yuan in all fiscal years except for the 2023 fiscal year when it turned losses into profits.

In addition to the huge input costs, the end of the era of consumption upgrading, and the arrival of the era of cost performance, the Internet giant turned around to guard the online entrance again. The low price war of e-commerce came and came, and offline retail became the new burden of the giant. Ali sold Yintai Department Store and Gaoxin retail shares successively, and Yonghui Supermarket also welcomed the "new owner" Ye Guofu.

In addition to the huge input costs, the end of the era of consumption upgrading, and the arrival of the era of cost performance, the Internet giant turned around to guard the online entrance again. The low price war of e-commerce came and came, and offline retail became the new burden of the giant. Ali sold Yintai Department Store and Gaoxin retail shares successively, and Yonghui Supermarket also welcomed the "new owner" Ye Guofu.

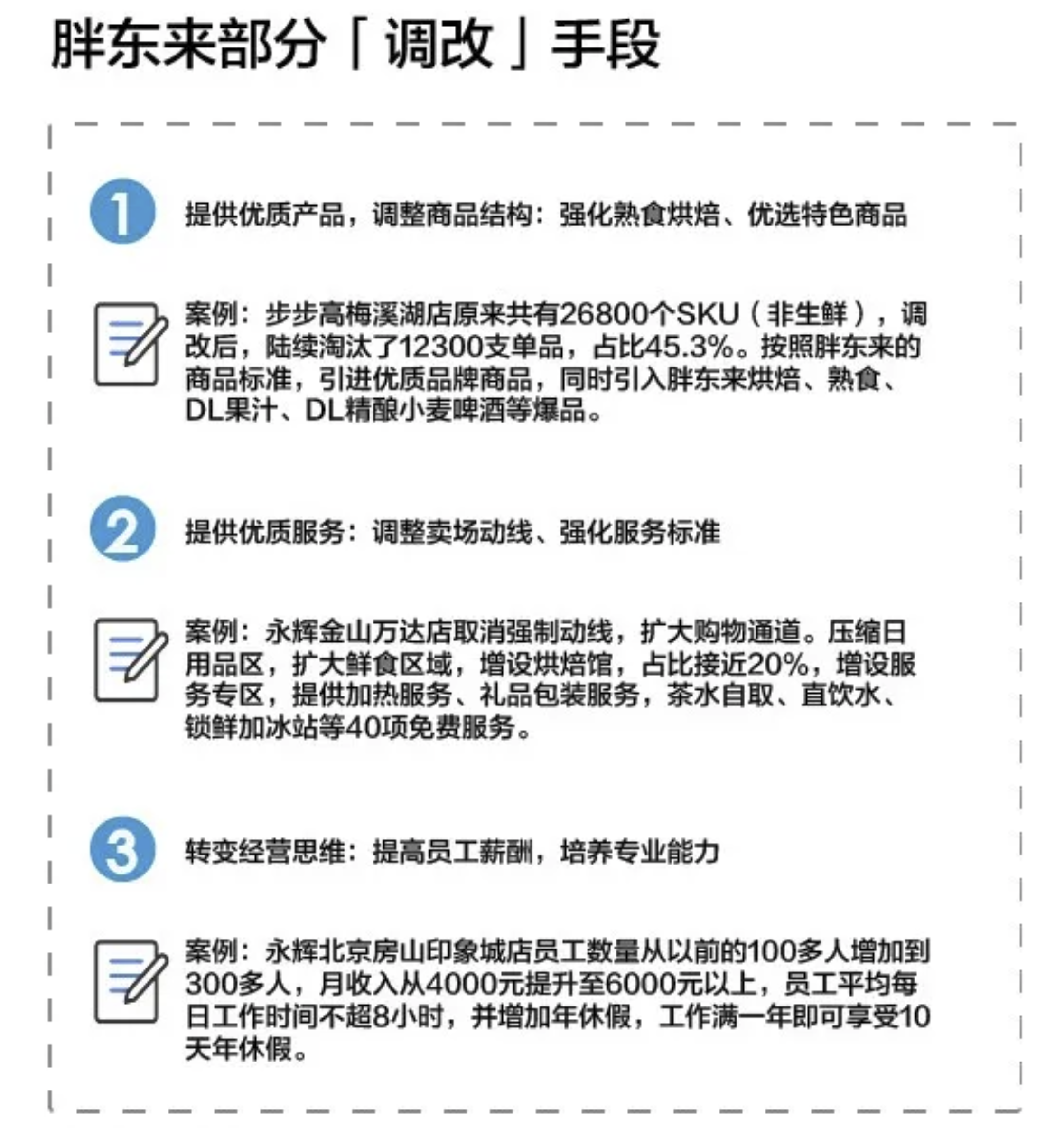

At the same time as the awakening of new retail, old retail is also beginning to awaken. Traditional supermarkets represented by Yonghui Supermarket and BBK have launched offline reforms, ushering in a new cycle of retail in China.

picture

New retail and old retail are both forms of retail

From 2000 to today's 25 years, we have all talked about e-commerce, traffic, and digitization, but no enterprise has actually done a good job in the essence of products. This is what I said, the traditional retail industry in China has been brought into the pit by e-commerce in the past 25 years, forgetting the essence of retail

As a representative of new retail, Hou Yi, former CEO of Hema, once summarized the core issues of Chinese retail as follows.

The essence of retail is nothing more than goods, prices, and services, and all retail giants seek balance in it. New retail and old retail are essentially still retail.

The "new retail experiment" of Internet giants is not all a failure.

At least as mentioned above, it makes traditional hypermarkets begin to reach out and touch goods, and begin to attach importance to the operation of goods and users, but these cannot go deep into the root of retail. In an industry of "bending over to pick up coins", the scale rule of the Internet platform bilateral market cannot be replicated offline.

The elements that drive a consumer into offline consumption and experience are also complex and diverse. Especially in an era of relative oversupply, even giants with scale advantages offline can't lie down. Wal Mart CEO Dong Minglun said frankly in an interview: "I never think scale can be a protective umbrella."

Why does the Chinese retail industry, which has been constantly transforming from everyone talking about Hema and everyone learning from Sam's Club, to the trend of "adjustment and reform" from Fat East, always fail to achieve results?

The reasons behind it are complex.

Firstly, it is the fragile ecosystem of China's retail industry itself.

Chen Liping, a professor at Capital University of Economics and Business, once mentioned that China's hypermarkets were born during the period of demographic dividend and rapid economic growth. While carrying abundant goods and consumption power, the first circulation revolution was formed between brand merchants, channel merchants, and retailers - retailers received venue fees (also known as back office fees) from distributors. In the traditional KA model, brand merchants and distributors held the pricing power of the supplied goods. In order to balance costs, distributors could only share the entrance fees equally among the product prices. Therefore, the prices of hypermarkets remained high for a long time, and hypermarkets did not have dominant power in the entire process.

This is also the legacy brought to us by the first circulation revolution in the past twenty years. This legacy still troubles the development of the retail industry, making the ecology of the retail industry very fragile and unable to withstand the impact online, "said Chen Liping.

The complicated zero supply relationship has also led to the huge inertia of traditional retail reform. Ye Guofu once commented that traditional retail: "It is difficult to do it yourself", which is why we see that traditional retail is self transforming by external forces, whether it is the fate of the Internet giant or the adjustment of fat East.

Secondly, the criteria for judging haste and impatience.

Pei Liang, honorary president of the China Chain Store Association, mentioned in an interview with "Narrow Broadcast" that people's evaluation criteria for retail growth rate, or success, are a capitalized concept: "When it comes to the strength of this enterprise, it means that it is the largest in scale, or where the old board is the richest person." This has led to people's erroneous understanding of the retail business, lack of patience, and always think that relying on scale to achieve miracles can win.

Finally, there is a more complex soil for survival.

On the one hand, the regionalization of the production and wholesale system of Chinese brand manufacturers and the fragmentation of consumer purchasing channels have led to a lower concentration of offline retailers in China compared to Europe and America.

On the other hand, the supply of goods in the Chinese market has long gone through the era of scarcity. In the new cycle where consumers are king, Chinese retail not only needs time to learn product operations and build supply chains, but also faces the contradiction between time and speed of foreign giants who are already proficient in these retail essentials, which amplifies anxiety.

The historical legacy issues and complex living conditions have also been attributed by traditional Chinese retailers to the "reasons of the times". Overcoming their own path dependence and changes in the times has always been their main task.

In 2025, Chinese retail does not believe in myths

In 2025, Chinese retail does not need to believe, nor does it need to believe in myths.

Internet companies represented by Alibaba chose to return to platform business. Traditional retail began to follow the example of Fat Dong Lai, and began to make reforms in commodity structure, store lines and infrastructure, staff professional ability and welfare.

As a regional medium-sized retailer, some industry insiders believe that Pangdonglai is more about bringing confidence to traditional retail to bring about change. What can traditional retail learn from Fat Donglai? Or, what should the Chinese retail industry do after returning to the essence of retail?

One is how to establish a strong and stable user trust, and the other is to build an entrepreneurial spirit that transcends cycles.

The former requires the support of commodity capability and supply chain capability.

On the product side, whether it is learning from Sam's Club, opening customers and other membership based giants who adhere to the principle of "wide SPU, narrow SKU", or building their own brands, the key is to find the differentiated value of the product. Don't just stare at competitors and copy homework, but work with excellent suppliers to innovate products. A brand businessman commented like this.

This also means that in the future, retailers will become manufacturing and development oriented retailers on the product side, building their own vertical supply chains, and zero supply relationships will shift from games to alliances.

Yonghui also discussed the transformation of the supply chain concept at the investor relations event in November last year. On the one hand, it requires product managers to research and understand user needs from a user perspective, and develop high-quality products. On the other hand, it is to grow together with supplier partners, master altruistic thinking, and work together to make products better.

But the prerequisite for doing a good job with the product is that the internal product or procurement department has sufficient discourse power, such as Sam's product department, which has the highest level of information confidentiality and discourse power. The second advantage is that the scale advantage of a single product is large enough to allow the supply chain to see considerable profits in the channel, which can motivate them to develop products together.

These reforms need to be implemented step by step and cannot be rushed.

The latter requires truly patient reformers, that is, entrepreneurial spirit that can overcome cycles.

The retail industry does not lack persistent entrepreneurs, such as Yu Donglai, Ye Guofu, and Huang Mingduan. Ye Guofu once said, 'The biggest concern for entrepreneurs is path dependence, and they must dare to deny themselves.'.

The key reason for Miniso's acquisition of Yonghui is to see the future potential of the new Yonghui. Ye Guofu believes that the future of Chinese retail is quality retail: "Yonghui's product quality is benchmarked against Sam's, and its lean philosophy, culture, and product specifications are benchmarked against Fat Donglai (no membership cards, no discount promotions, no large packaging)," he said in an interview.

To some extent, in the long river of global retail history, the development of Chinese retail over the past 30 years has only been a brief milestone, but it has already undergone tremendous ups and downs and changes.

But as Sam Walton, the founder of Wal Mart, said, "Facing the competition and constantly changing" is the only way to go through the cycle. Only by keeping pace with the times and taking the initiative to change, can we truly win back the hearts of consumers.

Scan the QR code to read on your phone